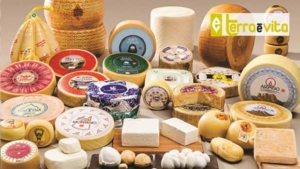

Lower interest rates than traditional loans , ease of disbursement and maintenance of the goods subject to constraint in the warehouses and cellars of agricultural companies or Protection Consortia. These are the advantages of the revolving pledge , a tool introduced in 2020 to facilitate obtaining liquidity by companies in the primary sector that produce food and beverages with a designation of origin . In addition to those of DOP cheeses , meats, cured meats and extra virgin olive oil, one of the sectors that can benefit from the revolving pledge is the wine sector.

In fact, in addition to the normal maturation times in the barrels needed for the musts to become great red wines, in recent years cellar stocks have increased due to declining domestic consumption and an export that travels at alternating current . The poor 2023 harvest has partly mitigated the problem, but the 2024 harvest is expected to be good if not abundant. However, companies need to finance their countryside activities and also invest to increase their competitiveness. One solution could be the revolving pledge . A similar argument can be made for hard cheeses, with maturation times ranging from 18 to over 40 months. Marco Mancinelli, head of the Agricultural Credit Organizational Unit of Iccrea Banca, explains the instrument in detail.

[…]

Source: Earth and Life